In the rapidly evolving digital economy, payment gateways have emerged as mission-critical infrastructure that underpins online transactions, customer trust, and commercial scalability. With a global valuation of USD 16.28 billion in 2024, the payment gateway market is projected to reach USD 34.81 billion by 2030, expanding at a compound annual growth rate (CAGR) of 16.44%. This forecast not only signifies robust expansion but underscores a paradigmatic shift in how businesses orchestrate digital commerce at scale.

This whitepaper provides a forward-looking view of the payment gateway market, exploring structural shifts, technological enablers, and strategic imperatives for enterprises seeking to leverage this momentum for competitive advantage.

Market Drivers: Forces Powering a High-Growth Trajectory

1. Seamless Digital Experiences as a Business Imperative

Digital transformation has matured beyond optionality. Consumers now expect not just access to digital storefronts but frictionless, secure, and instant checkout processes. In this context, the payment gateway becomes more than a transaction processor—it is a key determinant of user satisfaction and retention.

- One-click checkout experiences popularized by players like Amazon and Shopify are now baseline expectations.

- Mobile-first behavior drives the need for responsive, low-latency payment flows across devices.

2. E-commerce Globalization and Cross-Border Trade

The expansion of cross-border e-commerce, especially across Asia-Pacific and the Middle East, is pushing demand for multi-currency support, local payment methods, and intelligent fraud screening.

- Platforms are increasingly choosing gateways that offer localized UX, tax compliance, and real-time currency conversion.

- Growth in direct-to-consumer (DTC) business models is accelerating the need for flexible, customer-centric payment APIs.

3. Data-Driven Personalization and Security

Modern payment gateways are no longer passive intermediaries—they’re becoming data intelligence hubs. Through machine learning and real-time analytics, gateways can:

- Detect anomalous transactions

- Personalize offers based on purchase behavior

- Provide predictive risk scoring and customer insights

Companies that view payments as a data asset—rather than a backend utility—stand to unlock new value creation models.

Segmentation Analysis: Strategic Insights Across the Value Chain

A. By Type: Hosted Gateways Lead in Adoption

Hosted gateways, which offer pre-configured, secure checkout environments, continue to dominate due to their plug-and-play nature. These are especially favored by:

- SMEs lacking dedicated IT infrastructure

- Fast-growing e-commerce brands seeking rapid deployment

- Enterprises prioritizing compliance with global data regulations (e.g., GDPR, PSD2)

In contrast, non-hosted and integrated gateways remain attractive to large firms needing deep backend integration, real-time customization, and brand-consistent user flows.

B. By Enterprise Size: Large Enterprises Drive Innovation

While SMEs account for significant volume growth, large enterprises command higher ARPU (average revenue per user) and are more likely to invest in:

- Custom APIs and multi-platform integrations

- AI-based fraud prevention engines

- Tokenization and omnichannel architecture

These firms require gateways that can accommodate multi-country operations, recurring billing, and regulatory harmonization across regions.

C. By Industry: Beyond Retail & E-commerce

Although retail and e-commerce remain the dominant segments, payment gateways are gaining traction in adjacent verticals including:

- Healthcare: Enabling HIPAA-compliant patient billing

- Education: Supporting tuition payment and microtransaction models

- SaaS Platforms: Integrating metered billing and freemium upgrades

- Hospitality: Supporting multi-currency booking and refunds

These niche applications are reshaping how companies in non-traditional sectors approach customer monetization.

D. By Region: Divergent Maturity Levels

- North America maintains market leadership due to its fintech ecosystem and early-adopter consumer base.

- Asia-Pacific is emerging as the fastest-growing region, driven by mobile-first economies like India, Indonesia, and Vietnam.

- Africa is rapidly evolving, with mobile wallets (e.g., M-Pesa) leapfrogging traditional banking systems.

This geographic disparity demands gateways with regional adaptation strategies—balancing global scale with local compliance and cultural nuances.

Strategic Challenges: Barriers to Scalable Growth

While opportunities abound, the industry faces several systemic challenges that require executive attention:

1. Technical Debt and Legacy Infrastructure

Many incumbents are constrained by legacy payment stacks that lack modularity, scalability, and real-time capabilities. This inhibits integration with emerging technologies such as embedded finance or DeFi solutions.

2. Regulatory Complexity

Operating across jurisdictions brings exposure to a patchwork of data privacy laws, KYC mandates, and digital ID protocols. For instance:

- Europe’s PSD2 requires strong customer authentication (SCA)

- India enforces data localization for financial transactions

- The U.S. is increasingly focused on real-time fraud analytics under consumer protection frameworks

Gateways must design for compliance-as-a-service to remain competitive.

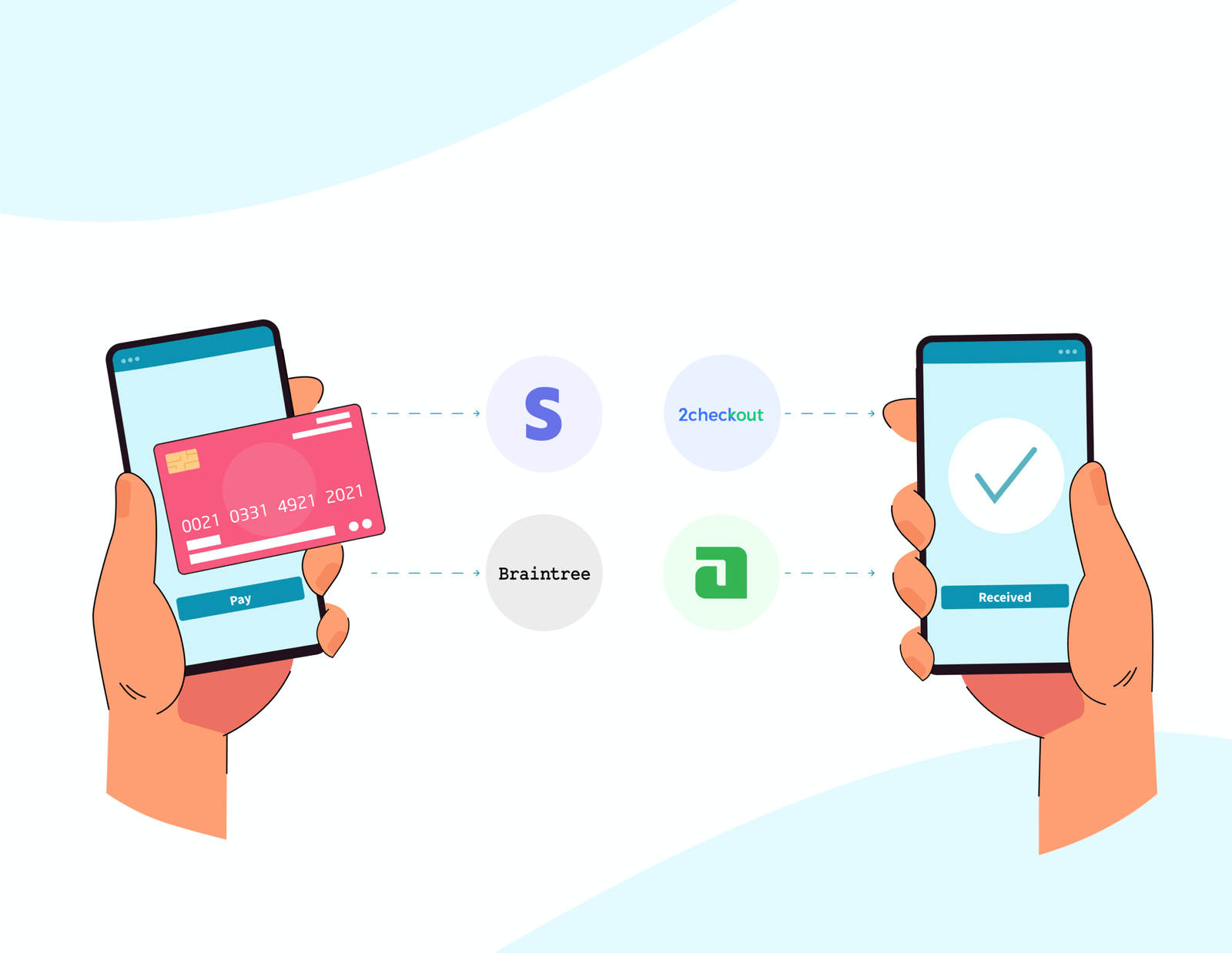

3. Integration Complexity Across Ecosystems

Fragmented systems lead to latency and reconciliation issues, particularly when businesses operate across multiple platforms (e.g., ERP, CRM, and POS systems). This creates a demand for middleware orchestration layers and low-code integration toolkits.

Opportunity Pathways: Strategic Levers for Market Leadership

To capitalize on current momentum, firms must prioritize the following innovation vectors:

1. Embedded Finance and API Monetization

Embedding payments directly into non-financial platforms—like ride-sharing apps, freelance marketplaces, or healthcare portals—presents an enormous growth lever. Winning players will:

- Build open, developer-friendly APIs

- Monetize usage tiers via analytics, risk services, and cross-sell products

- Support contextual payments triggered by behavior, not form submission

2. Next-Gen Payment Formats: BNPL, Crypto, and Wallets

As younger demographics move away from traditional credit, gateways that enable Buy Now, Pay Later (BNPL) options, crypto payments, and digital wallets will capture early loyalty.

- BNPL integrations have shown to boost average order value by 20–30%

- Crypto acceptance is increasingly expected by tech-savvy and international consumers

3. Developer-Centric Experience

Time-to-value is critical in the product economy. Gateways must reduce friction through:

- Clean API documentation and sandbox environments

- 24/7 developer support

- Flexible SDKs for major platforms (React, Node.js, Flutter, etc.)

This positions the payment gateway as a product-led growth enabler, rather than just a transactional utility.

Competitive Landscape: Who’s Setting the Benchmark?

Several market leaders are redefining category expectations:

- Stripe: Known for developer-first design, rapid onboarding, and extensible APIs

- Adyen: Offers unified commerce, intelligent routing, and a modular platform

- PayPal/Braintree: Pioneers in user trust and flexible integration across SMEs

- Amazon Payments: Capitalizes on ecosystem integration and consumer familiarity

Future contenders must combine platform extensibility, compliance agility, and UX excellence to stay ahead.

Conclusion: The Strategic Imperative

The global payment gateway market is no longer just a back-office function—it is a strategic lever for growth, innovation, and trust. Organizations that treat payment infrastructure as a customer experience and data intelligence function will unlock far greater value than those focused solely on cost and processing speed.

In a landscape where speed, security, and scale define market winners, the next decade will belong to those that embrace modularity, prioritize interoperability, and design around user behavior.